#1 The Mortgage Buster

This strategy can help smash down your mortgage. Read to find out how.

3 min read

Borrow more with Earn Baby Earn.

The best way to get the bank to lend you more money ... is to increase your income.

Here's how other Kiwis are doing it.

Earn Baby Earn aims to increase your income so you can have the option to borrow more from the banks.

Here are the main ways Kiwis do it:

#1 – Increase the number of hours your work. This often happens if one partner is working part-time

#2 – Negotiate for a higher pay package (i.e. ask your boss for a pay rise). There's a great case study about this below.

#3 – Return to work if one partner has taken time off to raise children, making it a double-income household.

#4 – Look for a new job that pays more. The big salary increases usually come when switching jobs.

#5 – Negotiate to change bonuses or commissions into salary. That way, the banks will often lend you more money.

No – but it's worth giving it a go if you're serious about investing in property.

Many of the investors we work with have success with “Earn Baby Earn”. Often they get pay rises they never thought were possible.

Remember – if you don’t ask, you don’t get.

Here's a case study to show you what's possible.

Lucy and Nathan, a young couple in their 30s, wanted to buy their first investment property.

Their own home was worth $750,000. They planned to borrow against it to buy an investment property.

But the bank wouldn't lend them the money.

Under the bank's calculations, they spent $300 more than they earned each month.

So in the bank’s eyes, they couldn’t afford a new loan.Lucy worked part-time (4 days a week), earning a salary of $60k. She hadn't got a pay rise in the last 2 years.

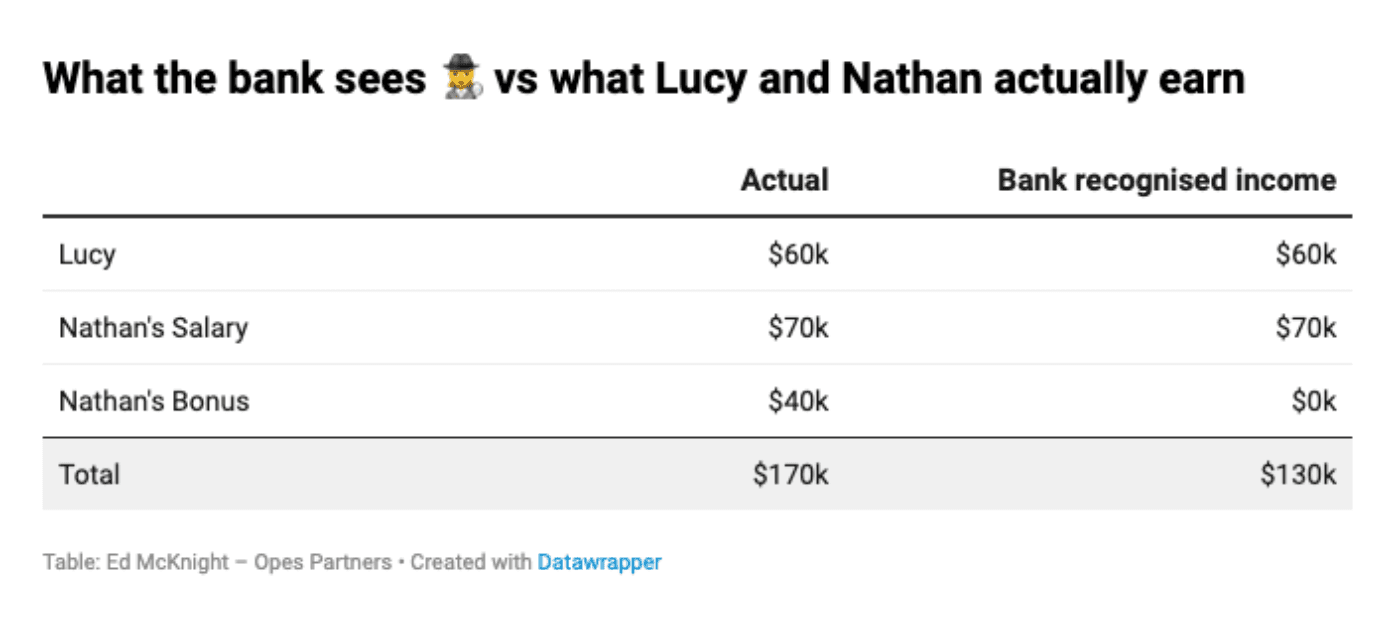

Nathan had a base salary of $70k and an annual bonus of $40k.

But while Nathan earned $110k all up, the bank would usually only use $90k of income in their calculations.

Banks often only use 50% of bonuses when running their numbers. This is also known as 'shading', this is usually because bonuses are considered to be given that the bosses discretion...

But there was another trick. The bank wouldn't use any of Nathan's bonuses in their calculations.

They wanted to see a 2-year track record of bonuses. But Nathan had only been in his job for 18 months.

So all up, the bank ran their numbers as if the couple earned $130k a year, even though they actually made $170k a year.

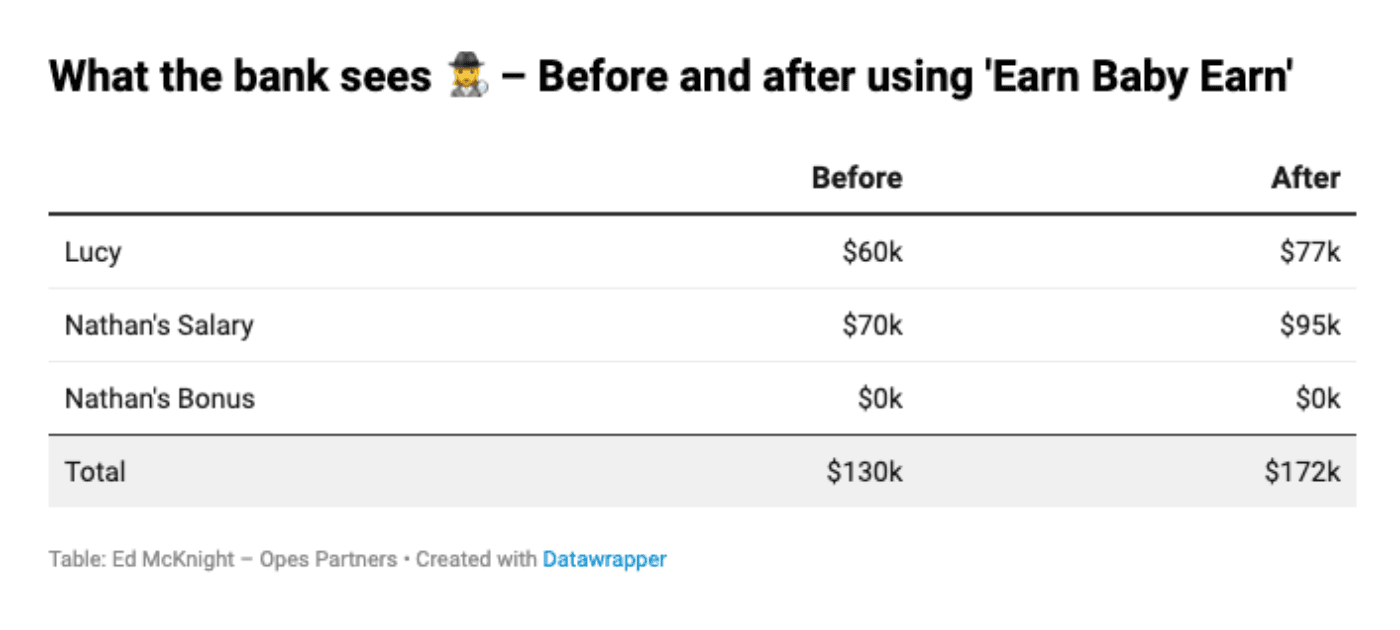

To bridge this gap, Nathan negotiated to change some of his bonus into salary.

His employer changed his contract, increasing his salary to $95k. But they decreased his bonuses to $15k.

The amount he gets paid didn't change.

But the bank is now more willing to lend him money.Lucy also took a proactive approach. She asked her boss if she could work more hours.

They agreed, and she moved from working 4 to 5 days a week.

She talked to her employer about:

And they gave her a pay rise.

The extra hours and pay rise gave her an extra $17k per year. That takes her total income to $77k.

So in the bank's eyes, this couple moved from an income of $130k up to $172k.

This impressed the bank and turned a 'no' into a 'yes'.

Over the last 6 articles, you've learned the six strategies you can use to get investment ready.

This newsletter aims to show that if the bank says “no” ... it's not a 'no' forever.

You can use these simple strategies to get in the position to borrow more.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser