#4 Commitment Issues

Ways to increase your serviceability for your mortgage application.

3 min read

Here’s the third strategy to help you master your mortgage – Reno to hero.

While the last strategy (split banking) is by far a favourite of ours at Catalyst …

Reno to Hero is a great option to consider if you already own property that has the potential for a cost-effective renovation.

The reno to hero strategy involves renovating a property to increase its value …

Allowing you to borrow more and use that extra money as a deposit for your next property.

Now, this comes out of my jurisdiction as it’s all about renovating.

So I’ve asked our good friends over at Opes Accelerate to help us out with this email to explain how this strategy can help you.

If you’ve listened to the Property Academy podcast, you’ll know who Ilse Wolfe is.

She’s the director of Opes Accelerate, teaching Kiwis how to build equity and cashflow through renovations.

Ilse’s rule of thumb is that the minimum return they aim for is $2 for every $1 you spend.

For this strategy to work, Ilse recommends focusing on the 6 Cashflow Hacking Steps to increase your property’s equity.

These include:Adding an extra bedroomMaking it a multi-income propertyRenovating bathrooms and the kitchenReplacing fixtures and fittingsPainting internal wallsCleaning or replacing the carpet

She suggests that if you are renovating an investment property …

Give your tenants notice to vacate the property so you can renovate it quickly and achieve the market rent afterward.

One tool she might use is setting up a revolving credit and using that to fund the renovation costs.

Whether the bank is willing to give you a revolving credit facility is very much dependent on your personal financial situation …

That’s where we can help.

Once the renovations are finished, the next step is to obtain a registered valuation establish the new value that you can borrow against.

Banks only accept panel valuers.

This means it is often easier for you to organise a valuation through your mortgage adviser.

We order your valuation direct with the panel valuers through Valocity or Core Logic (bank dependent).

Here’s how one of Opes Accelerate’s clients used the reno to hero strategy to get more lending …

Meet Milly and Jasper, who were starting their investment journey.

They had their sights set on purchasing a new townhouse in Christchurch for $600,000.

However, they soon found out that they would require a 20% deposit of $120,000, as advised by their mortgage adviser.

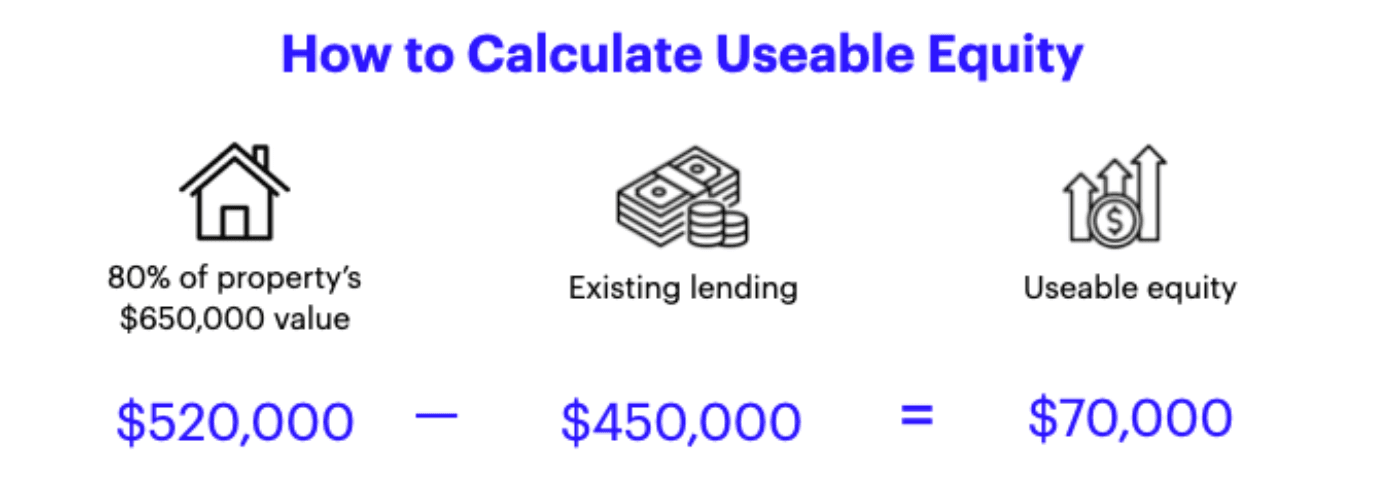

Although they already owned a property in Christchurch, its recent valuation came in at $650,000.

With an existing loan balance of $450,000, which left them with only $70,000 of useable equity.

Despite this, they remained determined to explore their options and make the investment a reality.

This was good but it didn't give them the deposit they needed to put towards a new build investment property.

Jasper was a builder and pretty handy on the tools so after talking with their adviser …

They decided to adopt the reno to hero strategy.

They consulted with their mortgage adviser and applied for a top-up on their existing lending from their bank.

This top-up was used to carry out renovations.

With the $50,000 top-up, they transformed the kitchen and bathroom and converted a second lounge into a third bedroom.

After the renovations were completed, they had their property revalued and were ecstatic to learn that its value had increased to $785,000.

By investing $50,000 in the renovations, they managed to add a remarkable $135,000 to the value of their property.

Adopting this strategy allowed Milly and Jasper to increase the usable equity in their property …

Which they could then use as a deposit for a New Build investment property.

Not only this but they had upgraded their owner occupier home making it a nicer space to live in.

The addition of a third bedroom meant they could rent out a spare room to a boarder for $200 a week.

Providing them with an additional source of income.

Handy tip: you can use Opes Accelerate to help you know which renovations to do for your property.

They’ll work with you to determine what opportunities exist in your portfolio.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser