#2 Split Banking

Use this strategy to increase your equity, allowing you to borrow more.

3 min read

While most Kiwis take 30+ years to pay off their mortgage … some manage to smash it down in half that time.

Some investors I’ve been working with this year (Charlie and Sarah) are on track to become mortgage free before they both turn 43.

To do it, they’re using the Mortgage Buster strategy.

Here’s how it works.

This strategy is simple … but it’s an effective way to change your behaviour to pay off your mortgage faster.

And you do it by changing how you set up your bank accounts.

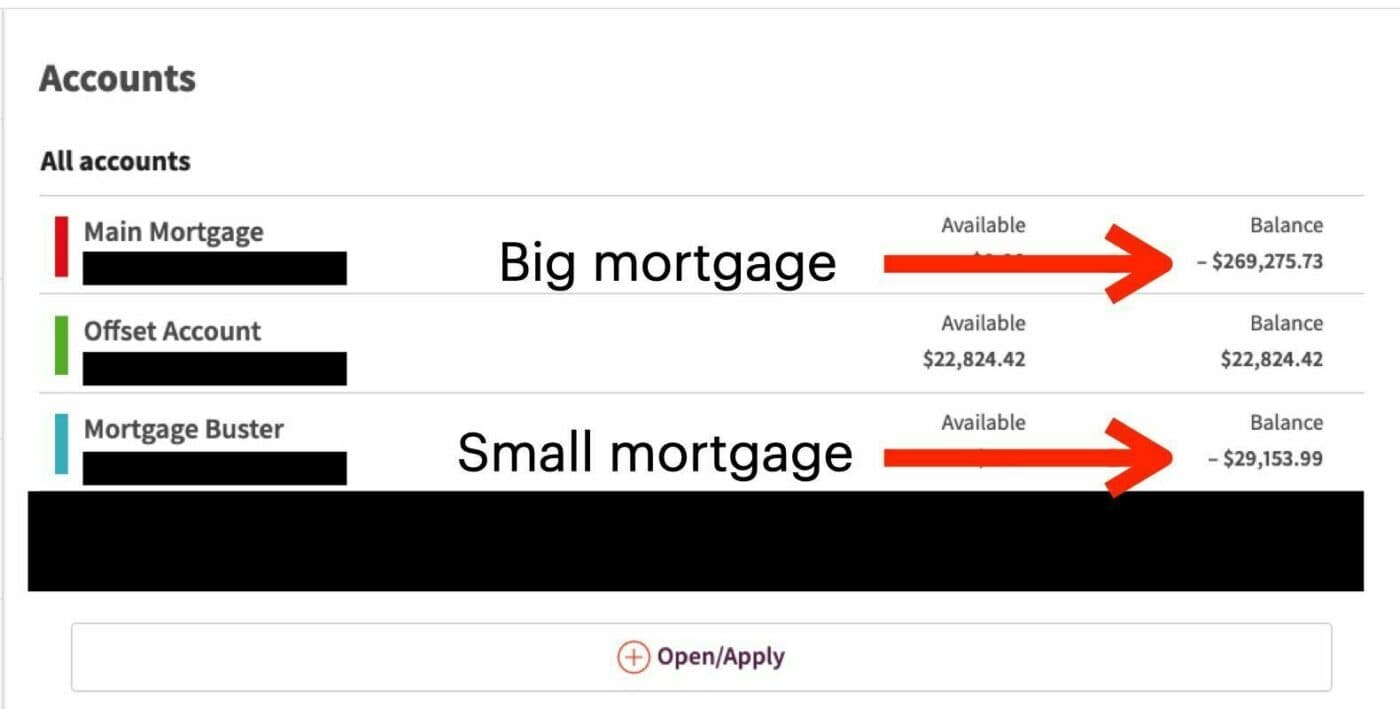

To set it up, you split your home loan into two parts:

The idea is – by biting off a small part of your mortgage, you can chew through it faster.

This changes your behaviour since you now have a set goal.Let’s be honest.

You won't see a noticeable difference if you put $200 extra into the giant abyss of a $500,000 mortgage.

Compare that to paying $200 off a $10,000 chunk of your mortgage. The difference will appear bigger, so you’ll be more motivated.

Here’s how to set up your Mortgage Buster

Step 1: Decide how much extra you can pay off against your mortgage, e.g. $200 per week. That’s about $10,000 a year – your savings goal for the year.

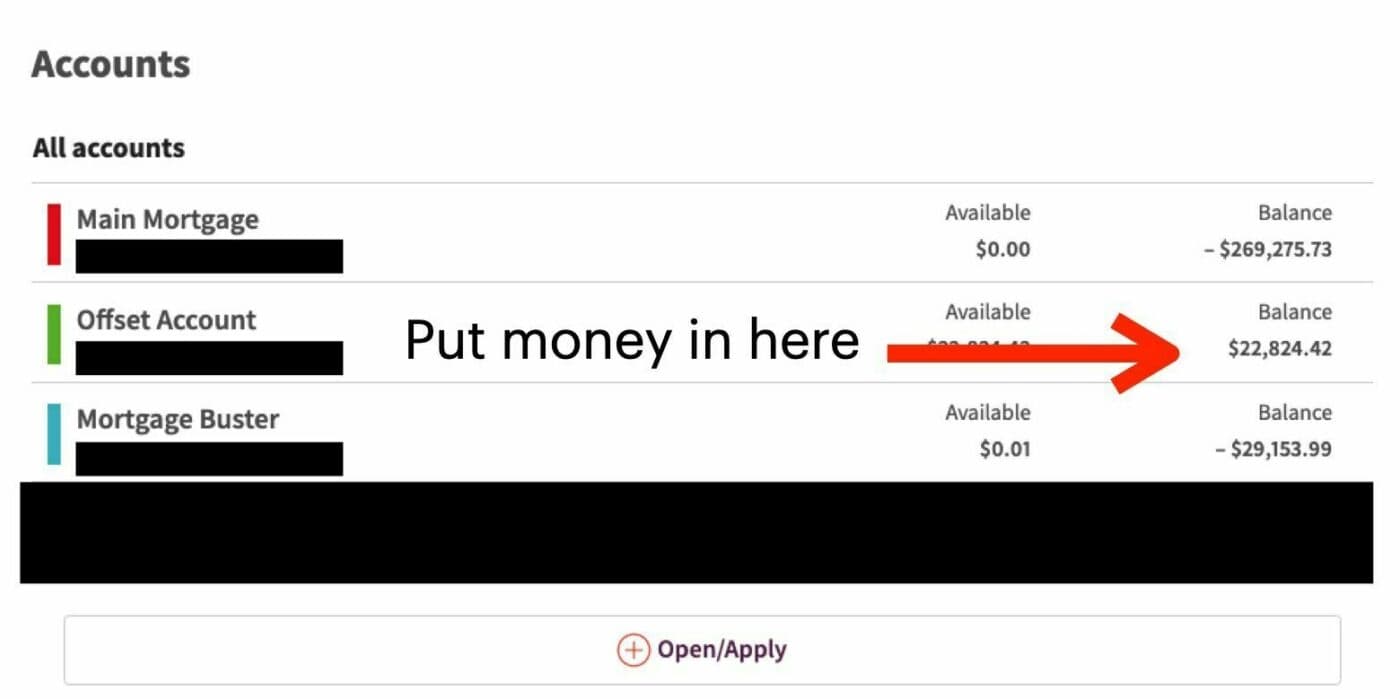

Step 2: Set up a revolving credit or offset account for that $10,000 chunk of your mortgage (more on below).

Step 3: Set the rest of the loan up to be paid off for as long as possible (e.g. 30 years).

If you’re unfamiliar – revolving credit and offset accounts are mortgages that give you more flexibility.

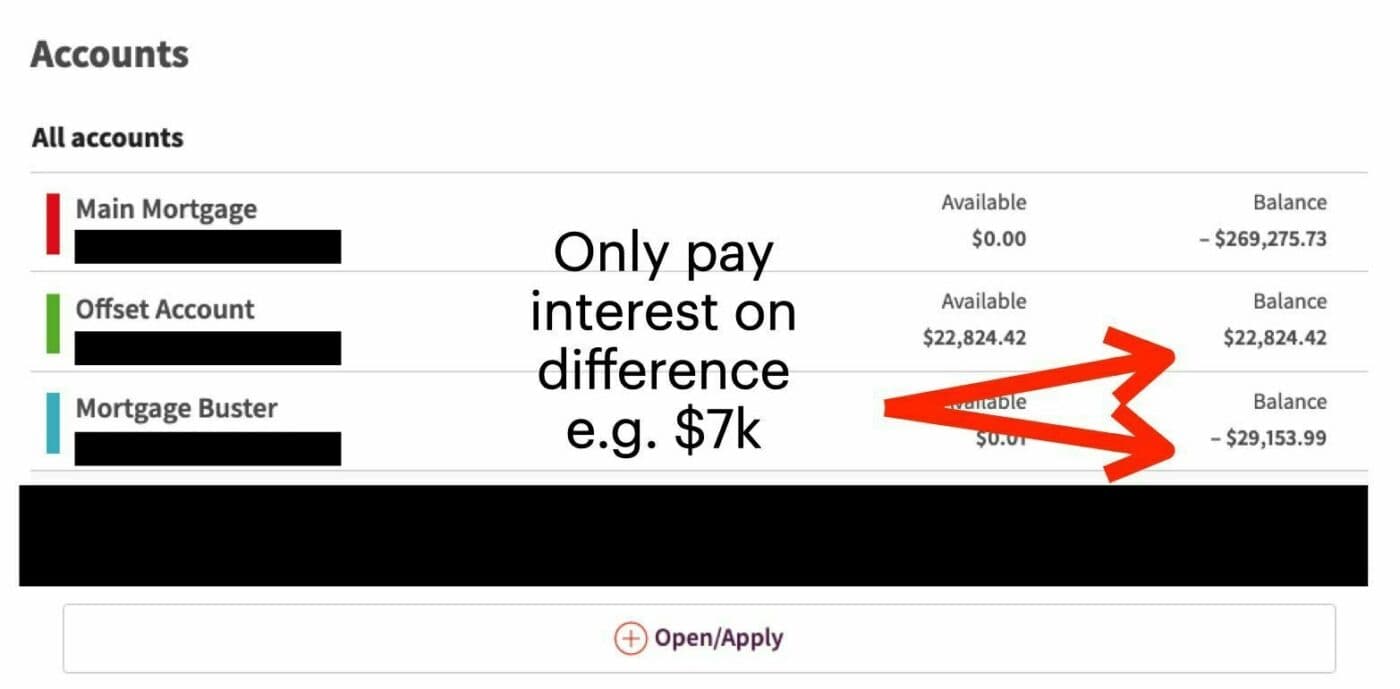

If you put more money into your revolving credit, the bank charges you less interest.

And like an overdraft, you can also take that money out anytime.

So if you save too much … and then get an unexpected car repair bill, you can still access the cash.

That’s not possible with a regular mortgage.

Once you’ve paid off this chunk of your mortgage within the year … bite off another chunk and do it again.

This sounds simple, but the following case study shows it can have significant results.

Charlie and Sarah had a $400,000 mortgage on their home.

That was a few years ago, and when I first met them, they wanted to pay it off before they both turn 43.

They decided to use the Mortgage Buster.

Before using this strategy, the pair had a 30-year mortgage and were on track to pay it off by the time they were 59.

First, Charlie and Sarah figured out they could put an extra $300 a week towards their mortgage. That’s $15k a year.

So they set up their revolving credit at $15,000 and fixed the rest of their mortgage ($385,000) to be paid off over 30 years.

At the end of the first year, their revolving credit was fully paid off, and they had $15k available in their account (remember, it’s like an overdraft).

So they took out that money and paid it off against their larger loan.

Then they started again … paying off their $15k revolving credit over the next year.

This became a bit of a game, and Charlie and Sarah challenged themselves to transfer more and more money into the account to decrease their mortgage even faster.

Right now, the pair are on track to pay off their mortgage by the time they are both 43.

Want to see if this strategy can help you smash down your mortgage?

Get in touch.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser